BUILDING YOUR BOARD: 3 pieces of advice from All Together’s latest CEO CIRCLE event –

Inspired by Huel founder Julian Hearn’s recent blog post – ‘6 Tips for Early Boardroom Success’, All Together’s latest CEO Circle discussed the opportunities and challenges of building a board.

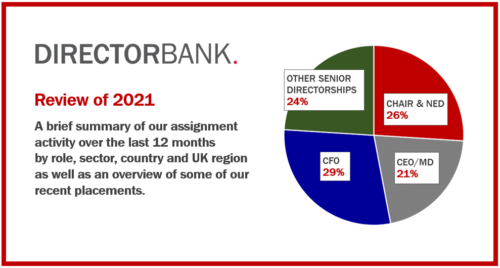

Directorbank’s George Heppenstall was invited to co-host the event and we are pleased to share a write up of the key discussion points below.

In Julian’s blog he explains just how important the early assembly of a productive board had been for his business, offering impartial, expert advice where otherwise he might have been alone. With so many of All Together’s CEO community wondering if the same might be true for them, a CEO Circle event was held to demystify the process of building a board.

1. Make your Chair the first person you call

Among those at the virtual table, few had hired board positions in their business before, so it was session host Christine Cross, serial chair and All Together Volunteer Advisor, who imparted the opening piece of advice: ‘Your Chair should be the first person you call when there’s trouble or when there’s something to celebrate.’

A good Chair will likely have deep experience running enterprises of all sizes, understanding the challenges and pitfalls leaders can suffer. They should be familiar with your business, working closely enough with you to be able to provide context to a situation, not just content, as a less involved advisor or mentor might. To Chris, the smaller the business, the closer the relationship between a Chair and the founders or CEO can be, however you must ensure they impart their experiences without being seen to take control.

For those seeking advice around non-execs, George Heppenstall, director at executive-level search firm Directorbank and a partner of All Together, advised that these roles were similar to Chair positions, although a little further removed. They offer valuable alternative perspectives, but won’t have the same level of involvement or responsibility for your business as Chairs, who shoulder a greater level of responsibility and commitment to the business.

2. Build your board early

As the conversation shifted to a question of ‘when,’ our experts echoed Julian Hearn’s advice that bringing a board together as soon as possible was likely to benefit your business. A tip for smaller companies was to start potential relationships informally at first, perhaps as an advisor, graduating to formal positions once it had been proven to work and a relationship built.

One CEO raised a simple ‘why?’ at this point. Why would they need a board when they had a great team and advisors they could turn to if needed? Here, our experts were unanimous in advising that there is a difference between the advice and support you get from advisors, who have no formal tie to your business, and board directors who share and shoulder responsibility for the company’s wellbeing.

Every leader of a management team will have their weaknesses, and each business will have an Achilles heel. If you think yours doesn’t, then perhaps you need to look harder. Being able to bring someone in with experience to plug those gaps and add value should be a no-brainer, if it’s feasible. It is often said that being a CEO can be a lonely job, but All Together’s Volunteer Advisors are deliberately time-limited (enabling them to help as many companies as possible). Having a board member you can open up to and trust would be a valuable long-term remedy.

One CEO demonstrated this in practical terms, explaining that despite having had a fantastic mentor they were grateful for, they realised they needed more support in specific areas to match an ambitious growth plan. They found someone with the experience they were lacking and hired them in a non-exec director position. Despite this being a recent change, the founder was keen to stress the positive impact this had already had on their business.

3. Like any hire, work out what you need first

For the third piece of advice, George was keen to stress the importance of understanding your desired outcomes from hiring a board member. What do you need from a potential hire? Where are you lacking in expertise? Where do you want the business to be in the future and what kind of person could help you achieve that? These kinds of questions are important and worth discussing honestly, both with yourself and any potential board-level hire.

The group were keen to ask how you might go about finding the right Chair or NED once you knew what you were looking for. Some had used LinkedIn to find their NED, saying that whilst this had been successful for them, it had been a long process which might easily have had a different outcome. An alternative route is to ask your investors for people they would recommend – your investors at least understand your business and can connect you with people they know could work. Finally, the robust solution would be to seek the services of a professional search firm, like Directorbank. While this would incur additional costs, you can be confident of a thorough process, as well as hands on support to help you think through exactly what it is you need. The over-riding advice here was that just sticking to your own network might not be the answer to finding those with skills and experiences different to your own.

How to pay NEDs or Chairs was one of the most commonly asked questions in the session. Our experts agreed that, unfortunately, there was no specific piece of advice to give here, except to recognise that lots of Chairs and NEDs will want different things. Some will only get involved in high growth businesses where they can take equity, while others prefer not to take equity (to remain truly independent). How much is then paid varies from person to person, but one piece of guidance unanimously agreed upon was that SMEs should never pay more than they can afford. This will put undue pressure on your business and potentially cause tension in the new relationship.

Despite being a short session, the CEO Circle event on Building a Board was full of practical advice. Clarifying what you want from your board, building it early and then treating your Chair as your closest ally will form the basis of a great team, and will undoubtedly leave you as a CEO feeling less alone.

Thanks must go to the team of hosts for delivering such an insightful event, as well as the CEO guests who shared their experiences, and finally to Julian Hearn, who’s wise words: ‘never be the smartest one in the room’ form the foundation of so many brilliant boardrooms.